Credit scores are so important when you’re getting ready to purchase a home. This metric helps loan officers determine your interest rate and also which loan programs you qualify for. In this six part series were going to give you the information you need to know in order to raise your FICO® score and increase your ability to qualify for a home loan.

Part 2: Minimize Your Use of Credit

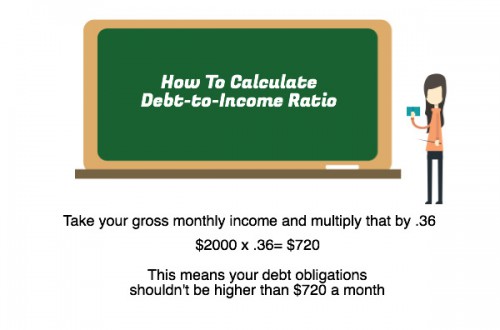

Debt-to-income ratio is the second biggest factor for determining your credit score. The debt-to-income ratio is the amount of available credit you have open compared to what you earn. It is so important we actually wrote a blog post about how to calculate your debt-to-income ratio.

According to myFICO.com, individuals with credit scores of 800 typically use only 7% of their available credit. Compared that number to people with scores of 650 who often are maxed out on their credit cards. When a person pays off a credit card, they may see an increase in the FICO® score.

Here are some things you can do to minimize your use of credit

1. Calculate your debt-to-income ratio

This might be scary but you need a place to start, here is what the mortgage experts at Advance Financial Group told us:

- Take your gross monthly income and multiply that by .36. The answer will tell you what your total debt obligations should be in order to have a healthy debt-to-income ratio.

2. Look at places to cut back

If your debt-to-income ratio is higher than 36% of your gross income you need to find ways to trim your budget. Make sure to track what and where you’re spending your money. Maybe instead of always eating out maybe you can start cooking meals at home? We’ve got a great collection of easy dishes on our Pinterest page. Take a look at all of your expenses and see how much you can put towards debt – you’d be surprised how much you can find when you look.

3. Increase your income

You may find that taking on a part-time job or finding a way to increase your earnings from work could also help increase debt-to-income ratio. Remember that if you bring in any income it will need to be on your tax return information in order for the loan officer to be able to use it for the purposes of qualifying you for a mortgage.

Also look at items you could sell to put towards debt – do you have clothes you never wear? Take them to consignment. Have a lot of random household items you no longer want or need? Consider throwing a yard sale (we’ve got a great guide here).

4. Ask for an increase of your credit limits

If you qualify you could get an increase in your credit limit – that will help with debt-to-income ratio so long as you do not charge anything more on the account.

5. Create a serious plan to eliminate credit card debt

There are several methods to paying down credit card debt. One popular method is the debt snowball where you focus on the lowest credit card debt and put every thing you can towards the balance, while still paying the minimums on your other cards. Another popular method is to rank the cards in terms of interest rates and pay off the higher interest rates first. Either way having a plan to tackle credit debt will open up your lending options.

Miss the first part of the series? Catch Up By Reading Part 1: Paying Your Bills On Time

Like This Article? You Might Also Enjoy These: