There are many opinions on when it is the appropriate time to refinance. Some say the rate needs to decrease by 2%. Some say 1%. Some say .50%. Which one is it? The truth is there is no one-size-fits-all answer. In order to properly determine whether its right to refinance, one must take into account the size of the loan. The larger the loan size, the smaller the drop in interest rate needs to be.

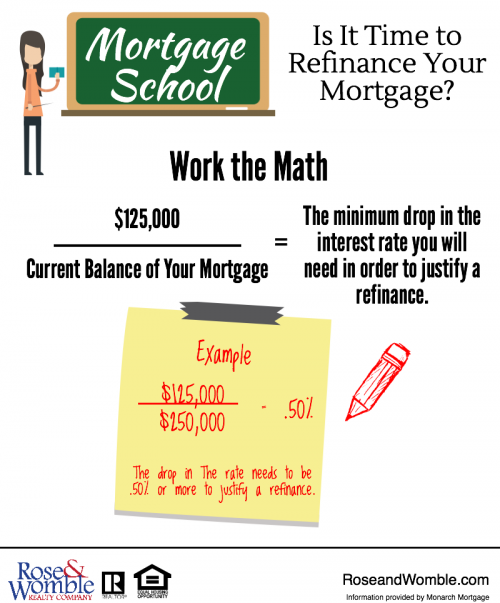

Here’s the formula. Take $125,000 and divide it by your current mortgage balance:

So for example if you have a $250,000 mortgage, $125,000 divided by $250,000 equals .50%. Therefore .50% is the minimum drop in rate you will need in order to justify a refinance. If your current balance is $500,000 ($125,000/$500,000) equals .25%.

While the above formula will assist in determining if refinancing is justifiable, everyone has their own threshold for how much in monthly savings they need to receive in order to refinance. For example for some even with a $400/mo savings is not enough to justify the ordeal of refinancing. Only you can determine what works best for you.

Information is provided by Kevin O’Neil, Mortgage Loan Officer from Monarch Mortgage. NMLSR #681811

Information is provided by Kevin O’Neil, Mortgage Loan Officer from Monarch Mortgage. NMLSR #681811